Corporations depreciate to account for this worth all through the useful lifetime of that asset. It is a exhausting and fast cost for the companies, and the quantity depreciated can be utilized to purchase new equipment after the old one turns into a scrap. The most typical methodology of depreciation used on a company’s monetary statements is the straight-line method. When the straight-line methodology is used each full year’s depreciation expense would be the identical amount.

Particular guidelines permit depletion of nonreproducible capital (such as a physique of ore being mined) for tax functions to exceed unique cost. Journal entries usually dated the last day of the accounting period to deliver the balance sheet and revenue assertion updated on the accrual basis of accounting. Included are the earnings assertion accounts (revenues, bills, positive aspects, losses), summary accounts (such as revenue summary), and a sole proprietor’s drawing account.

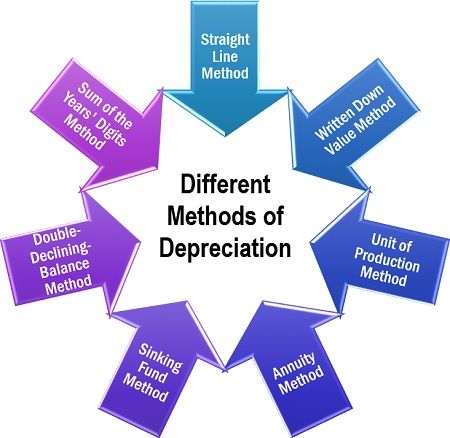

Another well-liked method is the Double-declining stability methodology – an accelerated depreciation methodology where extra of an asset’s cost is depreciated in the early years of the asset’s life. Regardless of the depreciation technique used, the entire quantity of depreciation expense over the useful lifetime of an asset cannot exceed the asset’s depreciable cost (asset’s price minus its estimated salvage value). Depreciation isn’t an asset or a liability itself—it’s a method used to measure the change in the carrying value of a fixed asset. It’s recorded as a contra-asset underneath the property section of your stability sheet.

The book worth of bonds payable is the combination of the accounts Bonds Payable and Low Cost on Bonds Payable or the mix of Bonds Payable and Premium on Bonds Payable. We will illustrate the details of depreciation, and particularly the straight-line depreciation method, with the next example. Accountants often say that the aim of depreciation is to match the cost of the truck with the revenues which are being earned by using the truck. Others say that the truck’s cost is being matched to the intervals in which the truck is being used up. We collaborate with business-to-business distributors, connecting them with potential patrons.

- Assuming there is no salvage value for the gear, the business will report $4 ($20,000/5,000 items) of depreciation expense for every item produced.

- Finally, the depreciated expense is computed by multiplying this price with the remaining fastened asset value after deducting the salvage value.

- Depreciation in accounting refers to an indirect and specific value that a company incurs every year whereas using a set asset similar to tools, equipment, or costly instruments.

- When you have a onerous and fast asset like a car, constructing, or piece of apparatus, these things will naturally endure some wear and tear over time.

Depreciation Vs Amortization

They help in understanding asset values, managing taxes, and ensuring long-term profitability. While these accounting methods have their limitations, when used appropriately, they supply valuable insights right into a company’s financial health. The items of manufacturing methodology is predicated on an asset’s usage, activity, or models of products produced. Therefore, depreciation would be greater in durations of high usage and lower in durations of low usage. This technique can be used to depreciate assets where variation in utilization is a crucial factor, corresponding to vehicles based mostly on miles driven or photocopiers on copies made.

Instance Of A Loss On Sale Of An Asset

An asset that can be depreciated is an asset that’s bodily and has a limited lifespan and a reasonably easy-to-determine fair market value. It’s very straightforward to know what this sort of asset is price at any given time. Depreciation and amortization are very related concepts that firms use to scale back the worth of belongings. It’s straightforward to get them confused, however it’s additionally necessary to grasp the difference since depreciated belongings are sometimes easier to worth. Depreciation is how an asset’s guide value is “used up” because it helps to generate revenue. In the case of the semi-trailer, such makes use of could be delivering goods to customers or transporting goods between warehouses and the manufacturing facility or stores.

It does not matter if the trailer could possibly be offered for $80,000 or $65,000 at this level; on the steadiness sheet, it is price $73,000. If an asset is fully depreciated but nonetheless in use, it ought to stay on the Stability Sheet, which paperwork the property, equity, and liabilities of a enterprise. If the equipment we bought is our solely asset and it has been fully https://www.simple-accounting.org/ depreciated, the Asset part of the Balance Sheet will look as follows.

The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. An expense reported on the income statement that didn’t require the use of cash through the period proven in the heading of the revenue assertion. Additionally, the write-down of an asset’s carrying amount will result in a noncash cost in opposition to earnings. Therefore, it is very important perceive that depreciation is a means of allocating an asset’s value to expense over the asset’s useful life.

What’s The Impression Of Depreciation On Web Revenue In Financial Statements?

Conversely, if an asset offers advantages based on its usage capability like the number of items produced for a plant, then it ought to be depreciated based on the number of items produced every month. A depreciation schedule1 is like a detailed plan displaying how a lot the value of each of your corporation assets decreases over time. Following are examples the place the depreciated quantity is calculated utilizing totally different methods.

Both strategies, however, are used to scale back the worth of assets for a enterprise, which lowers the company’s tax burden. Put very merely, depreciation is a method to scale back the worth of long-term property held by an organization and reduce taxation related to these property. Nonetheless, one can see that the amount of expense to charge is a perform of the assumptions made about both the asset’s lifetime and what it could be worth at the end of that lifetime. Those assumptions have an effect on both the web earnings and the e-book worth of the asset.

The number of years over which an asset is depreciated is determined by the asset’s estimated helpful life, or how lengthy the asset can be used. For example, the estimate useful life of a laptop computer computer is about 5 years. A depreciation schedule is a schedule that measures the decline within the worth of a exhausting and fast asset over its usable life. This helps you observe where you are in the depreciation course of and how much of the asset’s worth stays. After an asset is bought, an organization determines its useful life and salvage worth (if any).